CPH 2022 financial statements: profit of DKK 257 million and 22.1 million passengers

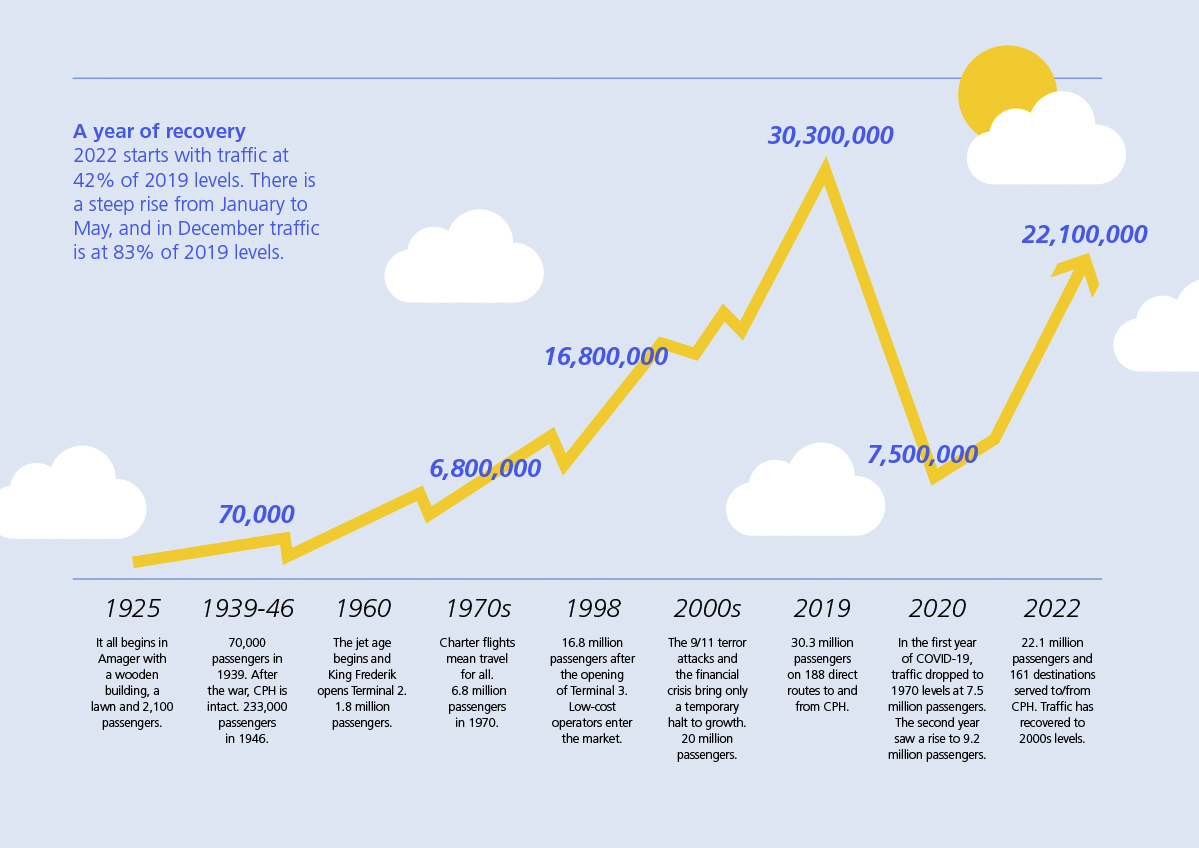

2022 saw the return of something closer to normal with our terminals and runways buzzing with activity again. Restarting the airport has required extraordinary efforts, and CPH welcomed 810 new employees – the highest number ever in one year. Passenger numbers totalled 22.1 million and, for the first time since the COVID crisis hit, CPH posted a pre-tax profit: DKK 257 million.

Providing Denmark with the best possible connectivity to the world remains Copenhagen Airport’s most important task. That mission was accomplished in 2022.

“The airport got back on track in 2022 but we still face challenges from global uncertainty and an additional debt of over DKK 2 billion accumulated as a result of the pandemic. This is why it’s crucial that the airport’s framework conditions fall into place in 2023,” says CEO Thomas Woldbye.

After a very quiet start to 2022, travel restrictions were lifted. This released several years of pent-up appetite for travel, so aviation had to be restarted in just a few months over the summer. CPH finished the year with 22.1 million passengers and a network almost back to pre-COVID levels, with 317 routes to 161 destinations.

“The contributions made by everyone throughout the airport have been impressive in terms of getting operations and air traffic back up and running, integrating new colleagues and generating the first profit since the global pandemic hit,” says Thomas Woldbye.

CPH took on 810 new employees in 2022 – the highest number ever – and now has a workforce of 2,450.

The 800 or so other businesses in and around the airport were also busy recruiting. Between the low point in 2021 and the end of 2022, more than 3,500 employees were re-employed, bringing the total number of people working on the airport site to around 16,500.

“The airport is one of Denmark’s largest economic ecosystems, with ripple effects extending far beyond our boundaries,” Thomas Woldbye emphasises.

Acceptable result

The airport’s finances have been severely tested by the pandemic. Over the first two – extremely challenging – years of the crisis, CPH accumulated a pre-tax loss of nearly DKK 1.5 billion, resulting in negative cash flow and an increase in debt from DKK 8.4 billion to DKK 10.5 billion.

“In this light, the pre-tax profit of DKK 257 million in this year’s financial statements is satisfactory considering the circumstances but is not at a level that can solve our future challenges,” Thomas Woldbye says.

In 2022, CPH obtained a further extension of waiver agreements concerning certain financial covenants until and including Q3 2024. Furthermore, the company is progressing negotiations relating to the refinancing of credit facilities totalling DKK 7 billion.

“Our debt has to be repaid, at the same time as we need to be able to invest in the airport of the future and maintain our position as a transport hub. This is a big challenge still ahead of us,” says Thomas Woldbye.

Revenue up 101%

By the end of the year, eight out of ten pre-COVID passengers were back. CPH posted revenue of DKK 3,532 million, up 101% on 2021, but still down 19% compared with 2019 – the last normal year before the pandemic.

The non-aeronautical part of the business – shops, hotels, parking and leasing – is crucial to CPH’s ability to invest. Non-aeronautical revenue was DKK 1,671 million in 2022 – a marked increase of 86% on 2021, but down 13% on 2019. Aeronautical revenue for the year was DKK 1,861 million, up 115% on 2021, but down 23% on 2019.

In broad terms, the aeronautical business represents around 60% of total revenue and 20% of profits at EBIT level. The non-aeronautical business accounts for around 80% of profit.

Framework conditions in place

A number of crucial framework conditions have to fall into place in 2023. The agreement between the airlines and CPH on the charges the airlines pay to use the airport expires this year and has to be renegotiated.

“CPH must continue to offer competitive prices. Nevertheless, the debt and rising cost levels mean that we cannot avoid higher charges if we are to be able to make the necessary investments in development and the green transition,” says Thomas Woldbye.

Another aspect of CPH’s framework conditions is the new planning act, which has just been out for consultation. A revised act will make it possible to free up an area within the existing land area to develop the airport, including building modern stands for new types of aircraft that produce lower CO2 emissions and less noise.

At the same time, steps can be taken to ensure that passengers are under one roof, have the shortest possible walking distances in the terminals and are close to public transport.

“Maintaining our position as an important hub in northern Europe requires reasonable framework conditions and the means to invest, so that CPH remains attractive to airlines and passengers. Otherwise, Denmark will lose ground to neighbouring countries,” says Thomas Woldbye.

Outlook for 2023

With 59 airlines flying to and from CPH, 2023 has started well – not least in terms of rebuilding the long-haul intercontinental routes, which have lagged slightly behind European traffic.

So far this year, new routes have been announced to New Delhi with Air India, New York JFK with SAS, Addis Ababa with Ethiopian, Montreal with Air Canada and Abu Dhabi with Etihad.

In 2023 revenue is expected to grow by more than 10% based on current market conditions. The growth is highly dependent on the passenger outlook which is expected to exceed 25 million passengers in 2023. The passenger increase is due to easing of COVID-19 restrictions and recovery of travel sentiment amongst others.

However, there is a high degree of uncertainty of the financial outlook due to volatility in energy prices, rising mortgage rates and high inflation as well as the geopolitical landscape.

If passenger levels reach around 25 million, profit before tax is expected to be between DKK 150 million to DKK 200 million mainly supported by growth in passengers offset by increasing operating costs and interest levels compared with 2022. The increasing cost levels are primarily due to the expected rise in passenger-related activities, regulatory requirements, salary increase expectations and inflation.

Download the full Annual Report here